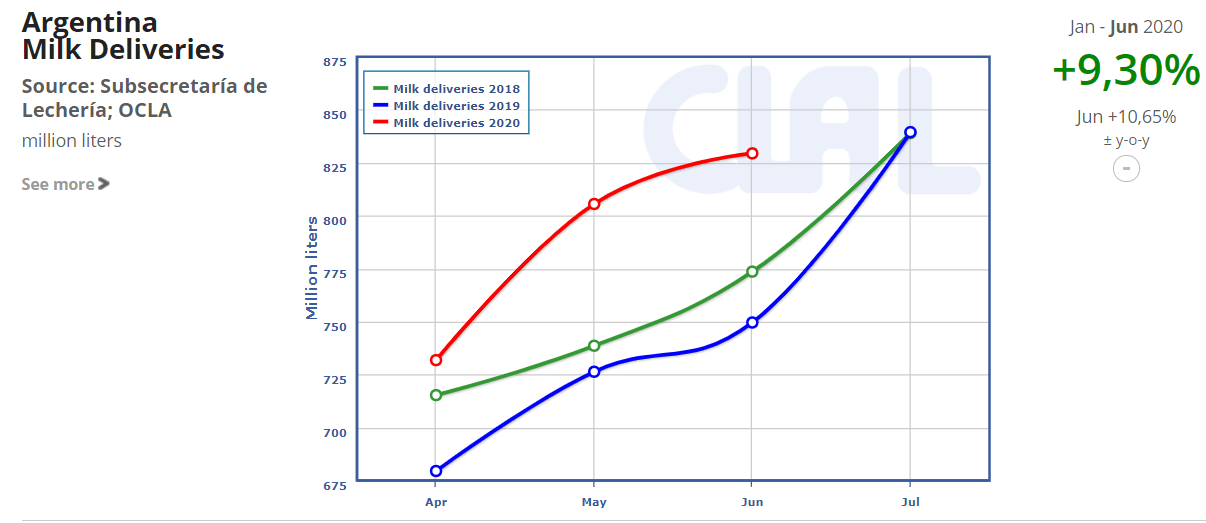

The increase in Milk production is expected to continue during the spring season.

The increase in production and the moderate operating costs helped to support farmers’ margins, even as farm-gate milk prices remained steady.

Raw milk supplies are enough to meet dairy processors’ needs. The industries in the sector are producing more UHT Milk to meet the needs of consumers, moreover, the production of cheese destined for pizzerias and restaurants is becoming more active as the food service sector continues to slowly reenter the economy.

Brazil -0.5% milk production January – June 2020

In the past couple of weeks, no major changes had happened in the South American skim milk powder (SMP) market, reflected on steady export prices.

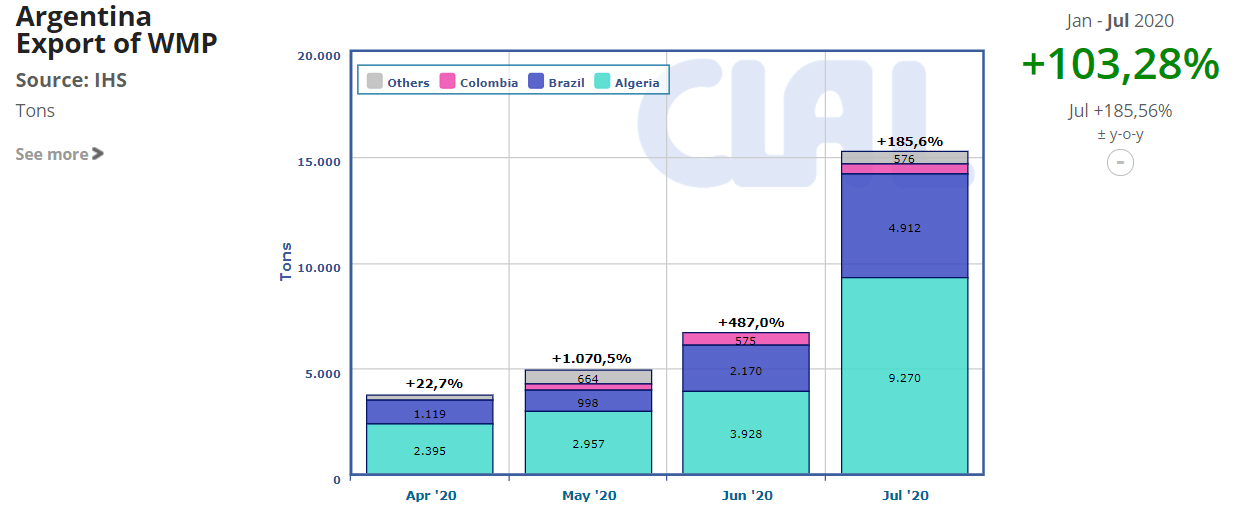

WMP export prices, on the other hand, are decreasing: with more milk available for dryers, the amount of WMP on the market is increasing, leading to a surplus.

Some operators manage to export the WMP produced in excess, exploiting the weakness of the local currency. In Argentina, the export of WMP continues to be strongly positive, recording in July an increase of +185.6%. The main purchasing country remains Algeria.

Source: USDA summarized by the CLAL Team Note: assessments about market trend are expressed in US$ More informations about dairy market in Argentina, Brazil and Chile are available on CLAL.it