Stephenson, director of the Center for Dairy Profitability at University of Wisconsin-Madison, spoke during a webinar Oct. 22 on his analysis of this year’s ups and downs and his predictions for the near future of dairy. Generally, things have improved since the spring, but the industry is still nowhere near normal and will not be for a while, he said.

“We’ve got the pandemic that’s clearly in the driver’s seat still, it’s not in the rearview mirror,” Stephenson said. “This is something that we’re going to have to deal with for some time period yet. And it’s impacting prices (with) more volatility than I’ve ever seen in my career.”

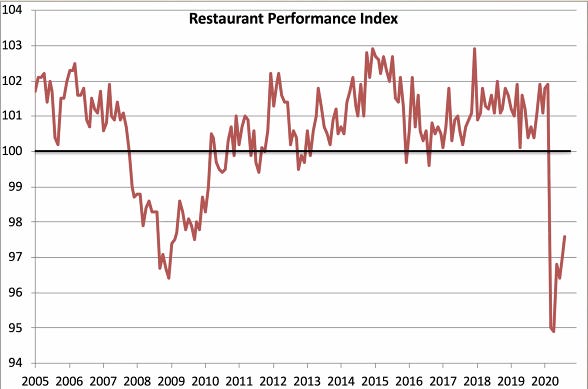

At-home cooking and eating is making up for the demand missing from the food service industry, which has been decimated by the COVID-19 pandemic, Stephenson said. He added that the national restaurant performance index always has highs and lows, especially a downturn during the 2008 recession, but in 2020 the downturn has been extremely sharp and at the lowest point of record since 2005.

While we are seeing upticks in restaurant activity, Stephenson said it’s not nearly enough to meet the average level of demand at this time of year, so the dairy industry should continue to focus on at-home cooking and eating as a means of selling product. However, one exception is cheese used for pizza – take-out pizza is surging right now, he said. The Farm to Family Food Box Program from the Farm Service Agency is also making cheese markets a bit tighter.

“We’ve had this Farm to Family Food Box that’s created a different kind of demand. Some of that was demand that might have been met through restaurant service before this happened or it might have been met through retail service,” Stephenson said. “But nevertheless, a lot of cheese was bought for these products or the food boxes and it’s had a big impact on our prices.”

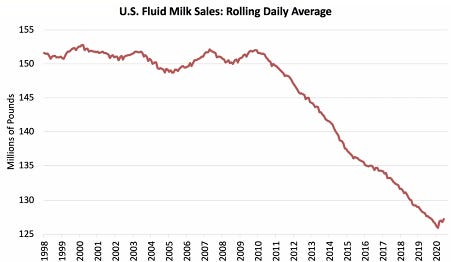

Stephenson also said that fluid milk, two-thirds of which is consumed at home, is actually going up in sales, reversing a downward trend consistent since 2010. The flip side to that, though, is that less popular milk alternatives, like skim milk, are being skipped over on the shelves in favor of crowd-pleasing 2% and whole fat varieties in order to keep shelves stocked consistently.

Butter sales are skyrocketing right now, Stephenson said, due to at-home cooking, which is helping make up for the demand losses from the food service industry. Butter commercial disappearance is up 7% currently. Total cheese consumption is also up in retail sales and down merely less than a percentage point for food service since April.

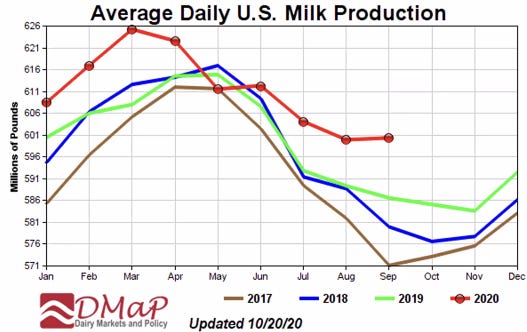

Milk production is also higher now than it was this time of year in the past three years. US dairies are producing on average 601 million pounds of milk a day right now – last year, the same average was 586 million pounds, and in 2017, the average was 571 million pounds after a sharp decline in production. Stephenson said the industry is meeting rising demand for dairy products after a disastrous spring, but he urged producers to be cautious about their production levels becoming too high.

“The urge to capture some of these higher milk prices has really officially put us into big increases right now,” Stephenson said. “I’m wondering if we kind of got our foot caught on the gas pedal a little too hard, but we’ll see as time reveals. Those pandemic prices haven’t been as bad as a lot of people, including myself, expected, but I’m really not sure how much much milk we can handle.”

Despite the mixed good news, Stephenson said we have a lot to worry about still, like the growing economic recession that will continue to cause widespread food insecurity and job loss. This can have serious implications for dairy as the middle and working class purchasing power weakens and restaurants suffer permanent shutdowns, he said. Many people out of work are members of the food service industry. The country’s unemployment rate sits at 8% right now, coming down from an all-time high of 15%.

Stephenson explained that the US economy heavily relies on consumerism, more so than many other countries – 71% of our gross domestic product on average is due to consumer purchases, while the United Kingdom is only second at 66%, and China in eighth at 34%. Because so many people are out of work and can’t afford to buy the same things they usually do, that will cause serious damage to our economy, including the dairy industry, Stephenson said.

“When consumption can’t be maintained like we’re having in our current recession, then it has a lot to do with what kind of gross domestic product you’re able to sustain,” Stephenson said. “I think our economy may have a long-term hit, and this impacts things like export opportunities.”

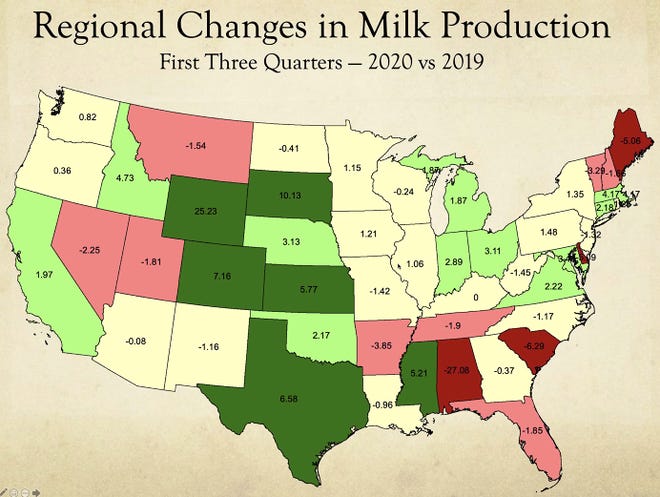

Milk production improved the most in the Central Plains region this year, with Wyoming production up more than 25% and South Dakota up 10%. In contrast, dairies in the Southeast and Northeast suffered the most, with Alabama milk production down 27%, South Carolina down over 6% and Maine down 5%. In Wisconsin, milk production went down less than a half of a percentage point.

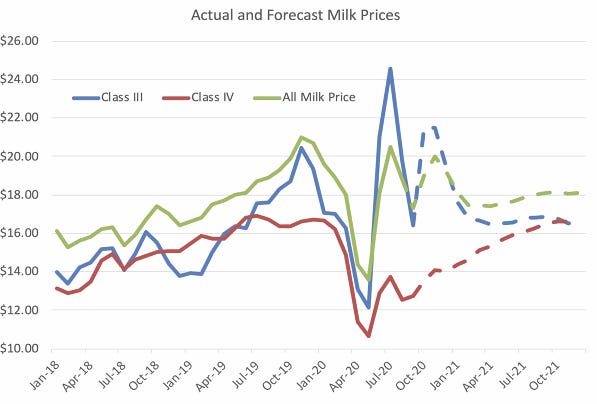

Stephenson expects the all-milk price to stabilize by spring 2021 around $18 per hundredweight after the price experienced a sharp decrease to below $14 cwt. in May and back up above $20 cwt. in July. He predicts that the all-milk price will climb from November to December, decline in January and February and then even out from there. Stephenson also predicts a consistent rise in Class IV prices.

Stephenson urged dairy farmers to sign up for Dairy Margin Coverage insurance from the US Department of Agriculture, for which 2021 enrollment closes Dec. 11 this year. He added that more Coronavirus Food Assistance Program payments are not certain and the DMC is the best bet dairy farmers have at recovering lost profits.

“We’re now at a point where we’re expecting the first half to two-thirds of 2021 could have payments at the $9.50 level. Clearly, markets are volatile and they’re going to change, but even with this we’re anticipating (DMC) payments,” Stephenson said. “We won’t be able to count on CFAP payments next year, but the DMC will be there and so will Dairy-RP and other things.”