- Mounting debts on NZ Agriculture dairy sector have discouraged the dairy farmers from operating the farms.

New technologies like plant and synthetic proteins would be a big threat for dairy industry due to cost effectiveness. - Dairy industry leader, Fonterra felt the heat taking into consideration the Company’s decision to sell out its Chinese dairy farms to its local peer owing to higher operating costs.

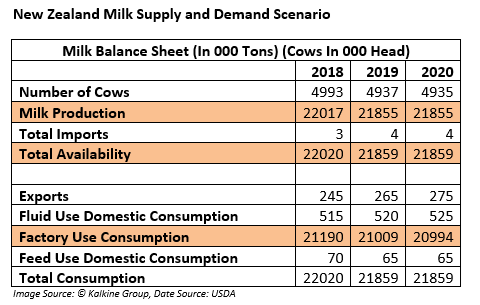

- New Zealand’s dairy industry is flourishing due to rapid increase in milk production by 28% during the period 2010-2020. New Zealand produced 21.90 million tons of milk in 2020 compared to 17.17 million tons milk produced in 2010.

However, as of now, the above data suggests that the reducing number of cows resulted in the marginal decline of milk production. Higher debt, uncertain situation for farmers, increasing regulations on industries, with regards to climate by government have together slowly discourage the farmers to operate the dairy farms.

Decline in the number of Dairy Cows/Milk production

The above balance sheet suggests, the number of dairy cows started reducing after being on peak for many consecutive years. According to USDA, the total dairy cow numbers declined marginally by 0.04% to 4.935 million in 2020.

A similar trend can be seen in milk production as well, which became stagnant and slipped downwards. On export front, liquid milk export was estimated at 275000 tons in 2020, which is 4% higher compared to 2019. The demand of milk from factories and for feed purpose also estimated lower in 2020 compared to last year.

International milk powder price rose by 1.7% to stand at US$ 3,041 in the auction held on Tuesday, 6 October 2020. Whole Milk Powder prices have been consolidating in a range of US$ 2800- US$ 3200, from last 4 years.

GDT price index also rose along with volumes in the first global dairy auction of the month held at GDT Events. GDT price index surged 2.2 percent to be noted at US$ 3,143 per ton on Tuesday. This auction is generally held twice a month, with the next auction scheduled on 20th October 2020.

Challenges in front of Fonterra Co-Operative Group Limited

Plant Proteins: Dairy without Cows

New Zealand dairy companies are earning profit by selling food ingredients powder containing high protein. However, presently, there are technologies that have developed products like plant proteins to compete with the dairy industry.

Plant proteins are made by taking out the protein from plants like soy, pea, and rice to make food ingredients.

With the cost effectiveness, these plant proteins are set to replace the dairy proteins from people’s food, which will become a big challenge for the dairy industry.

Synthetic Dairy Products: A threat to Dairy Industry

Synthetic protein is another technology, which could create potential risk for dairy products. Various industries use yeast and other microbes to create dairy proteins. By mixing yeast, sugar, and water, fermentation takes place, which turns the sugar into dairy proteins.

Government Regulations on Water Quality:

With increasing government regulations over the limit of releasing farm wastes like nitrogen, phosphate, etc to the rivers, some dairy farms would find it difficult to manage the extra cost to remove the on-farm effects on water bodies, while adhering to the new government rules.

Food Quality Related Risk

Being a dairy processor, Fonterra is exposed to the risk of providing lower quality food products, which will raise a question mark on food safety, and could damage the brand and reputation of the Company in front of consumers.

From reducing partnership Stakes to Selling Chinese Dairy Farm: Fonterra Starts Feeling the Heat

Dairy sector, pioneer Fonterra Co-operative Group recently sold its Chinese dairy farms to the local rival entity of China for NZ$ 555 million to pay off debts.

Last year, Fonterra decided to reduce its partnership stake in Chinese infant milk producer Beingmate due to higher costs incurred while operating the farms in China.

Fonterra’s Annual Report

Last month, Fonterra in its annual results for 2019-20 period announced profit after tax of NZ$659 million taking the total to NZ$1.3 billion. Total Group’s Earnings before interest and tax (EBIT) stood at NZ$1.1 billion up NZ$1.2 billion.

Fonterra announced a dividend of NZ 0.5 cents per share for the financial year 2020. Also, final Farmgate milk price for 2019-20 season was noted at NZ$7.14 per kgMS.

On the outlook front, Fonterra announced a 2020/21 earnings guidance range of 20-35 cents per share and has also reaffirmed its 2020/21 forecast Farmgate Milk Price in the range of NZ$5.90- NZ$6.90 per kgMS.

On 9 October, Fonterra’s share price closed flat at NZ$4.03.