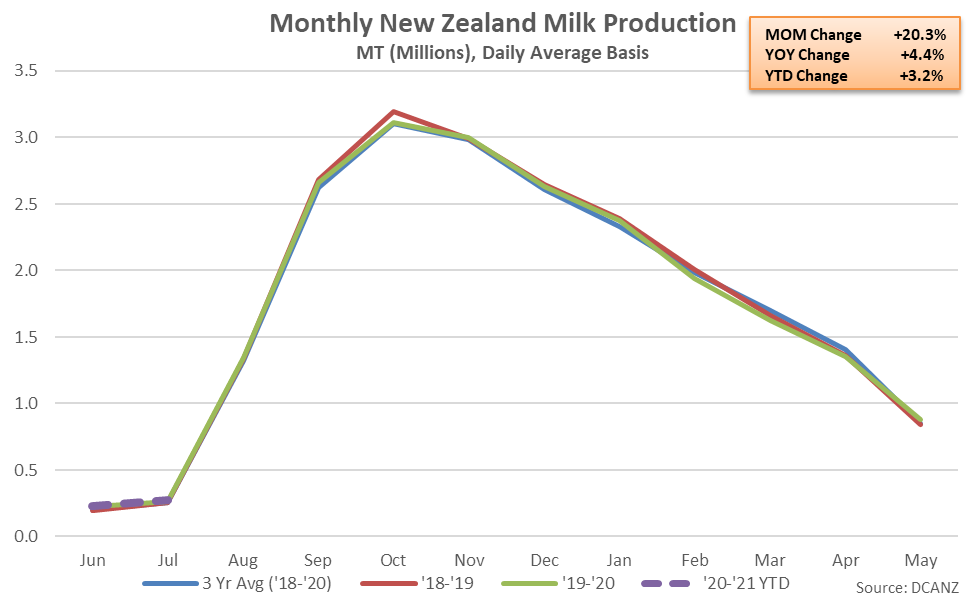

- Jul ’20 New Zealand milk production volumes remained near seasonal lows but reached a record high seasonal level for the third consecutive month, finishing up 4.4% YOY.

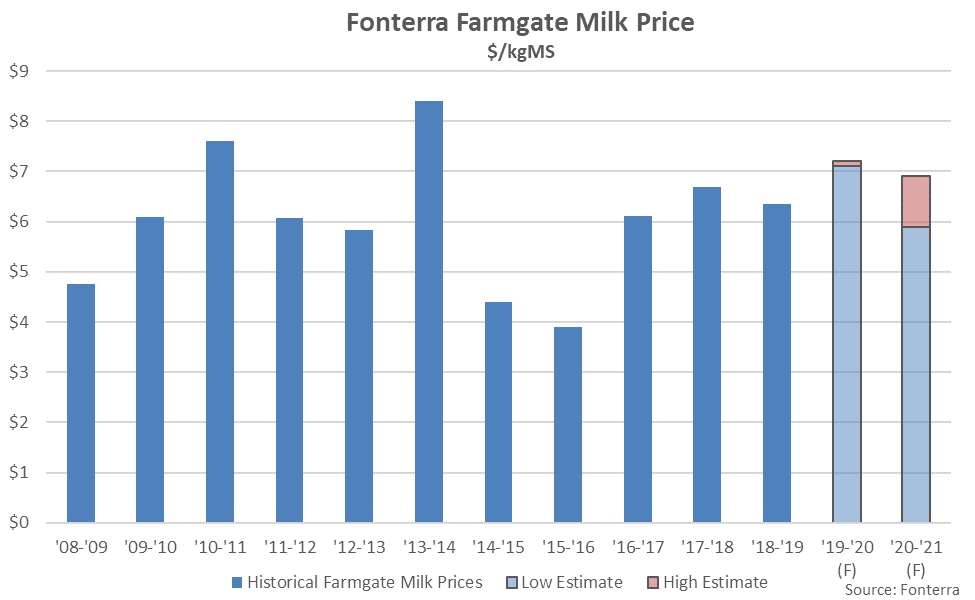

- Fonterra announced an opening ’20-’21 farmgate milk price forecast of $5.40-$6.90/kgMS during May ’20, with the wide range reflecting the heightened uncertainty surrounding the COVID-19 outlook. The ’20-’21 farmgate milk price forecast was revised $0.50/kgMS higher on the low end of the range during Jul ’20 while remaining unchanged on the high end of the price range.

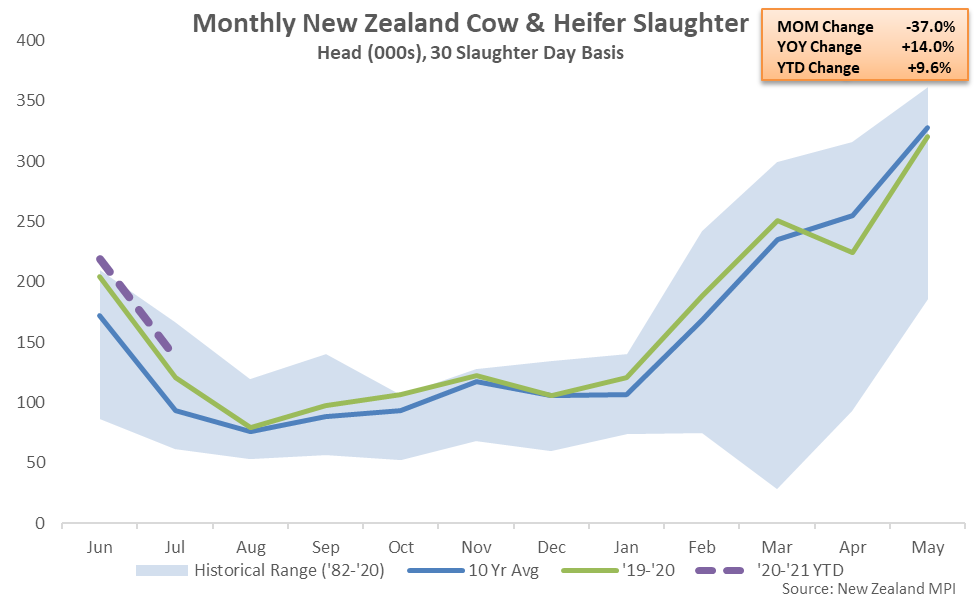

- New Zealand cow & heifer slaughter rates increased 14.0% on a YOY basis during Jul ’20 when normalizing for slaughter days, reaching a 34 year high seasonal level.

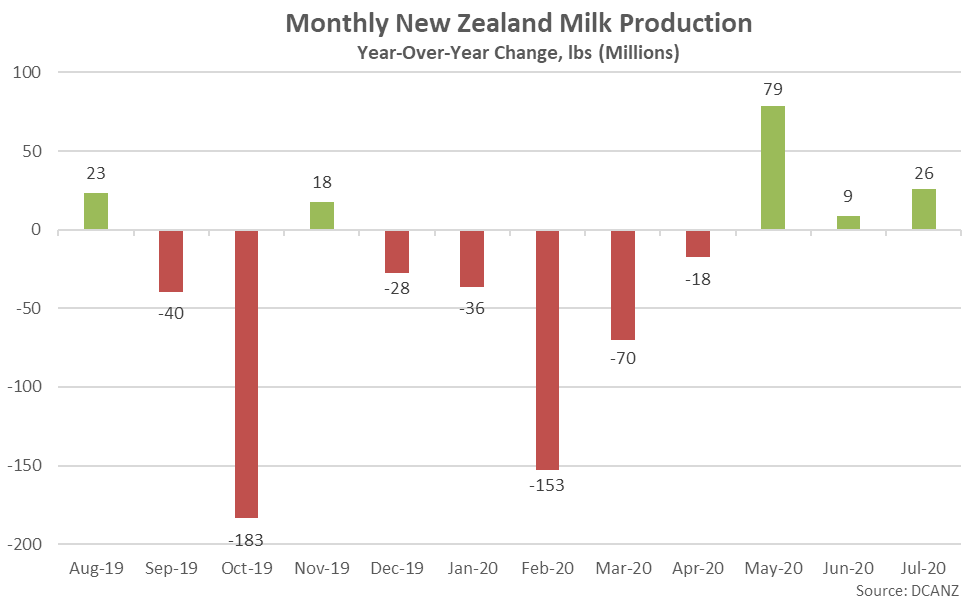

Additional Report Details Milk Production According to Dairy Companies Association of New Zealand (DCANZ), Jul ’20 New Zealand milk production volumes remained near seasonal low levels but finished 4.4% higher on a YOY basis, reaching a record high seasonal level for the month of July. On a milk-solids basis, production increased 5.3% YOY, also reaching a record high seasonal level. New Zealand milk production volumes reach seasonal lows throughout the months of June and July, with combined production volumes experienced throughout the two month period accounting for less than two percent of total annual volumes over the past ten years.  The Jul ’20 YOY increase in New Zealand milk production volumes was the third experienced in a row. New Zealand milk production volumes had finished lower on a YOY basis over seven of the past eight months prior to the three most recent increases in production. ’19-’20 annual milk production volumes declined 0.7% on a YOY basis however production on a milk-solids basis increased 0.3% YOY throughout the period. Recently experienced drought conditions, particularly on the North Island, impacted the milk supply throughout the ’19-’20 production season. COVID-19 has not impacted the milk supply to date as volumes remain near seasonal lows but is likely to disrupt export supply chains throughout the second half of 2020.

The Jul ’20 YOY increase in New Zealand milk production volumes was the third experienced in a row. New Zealand milk production volumes had finished lower on a YOY basis over seven of the past eight months prior to the three most recent increases in production. ’19-’20 annual milk production volumes declined 0.7% on a YOY basis however production on a milk-solids basis increased 0.3% YOY throughout the period. Recently experienced drought conditions, particularly on the North Island, impacted the milk supply throughout the ’19-’20 production season. COVID-19 has not impacted the milk supply to date as volumes remain near seasonal lows but is likely to disrupt export supply chains throughout the second half of 2020.  Farmgate Milk Prices Fonterra’s current ’19-’20 farmgate milk price forecast was reduced to a midpoint of $7.15/kgMS during Jul ’20, down slightly from the previous midpoint of $7.20/kgMS, citing a strengthening New Zealand dollar relative to the U.S. dollar over the past two months. The ’19-’20 farmgate milk price forecast remains on pace to reach a six year high level. Fonterra announced an opening ’20-’21 farmgate milk price forecast of $5.40-$6.90/kgMS during May ’20, with the wide range reflecting the heightened uncertainty surrounding the COVID-19 outlook. The ’20-’21 farmgate milk price forecast was revised $0.50/kgMS higher on the low end of the range during Jul ’20 while remaining unchanged on the high end of the price range. Improved market conditions within China were cited as the driver behind the increase on the bottom end of the price range.

Farmgate Milk Prices Fonterra’s current ’19-’20 farmgate milk price forecast was reduced to a midpoint of $7.15/kgMS during Jul ’20, down slightly from the previous midpoint of $7.20/kgMS, citing a strengthening New Zealand dollar relative to the U.S. dollar over the past two months. The ’19-’20 farmgate milk price forecast remains on pace to reach a six year high level. Fonterra announced an opening ’20-’21 farmgate milk price forecast of $5.40-$6.90/kgMS during May ’20, with the wide range reflecting the heightened uncertainty surrounding the COVID-19 outlook. The ’20-’21 farmgate milk price forecast was revised $0.50/kgMS higher on the low end of the range during Jul ’20 while remaining unchanged on the high end of the price range. Improved market conditions within China were cited as the driver behind the increase on the bottom end of the price range.  Cow & Heifer Slaughter New Zealand cow & heifer slaughter rates increased 14.0% on a YOY basis during Jul ’20 when normalizing for slaughter days, reaching a 34 year high seasonal level. The YOY increase in New Zealand cow & heifer slaughter rates was the second experienced in a row. Jul ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the second consecutive month, finishing up 7.0%. ’19-’20 annual New Zealand cow & heifer slaughter rates rebounded 2.7% from the previous year, reaching a four year high level. ’20-’21 YTD New Zealand cow & heifer slaughter rates have increased by an additional 9.6% on a YOY basis throughout the first two months of the production season.

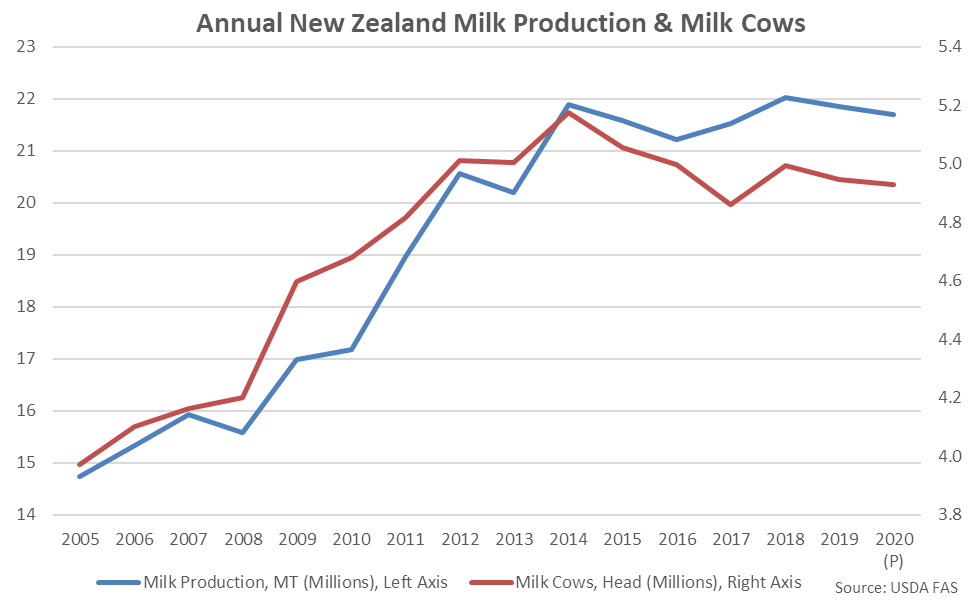

Cow & Heifer Slaughter New Zealand cow & heifer slaughter rates increased 14.0% on a YOY basis during Jul ’20 when normalizing for slaughter days, reaching a 34 year high seasonal level. The YOY increase in New Zealand cow & heifer slaughter rates was the second experienced in a row. Jul ’20 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the second consecutive month, finishing up 7.0%. ’19-’20 annual New Zealand cow & heifer slaughter rates rebounded 2.7% from the previous year, reaching a four year high level. ’20-’21 YTD New Zealand cow & heifer slaughter rates have increased by an additional 9.6% on a YOY basis throughout the first two months of the production season.  New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline slightly on a YOY basis throughout 2020 but remain above the six year low level experienced throughout 2017.