This article is a re-post of the September 2020 Insight, from NZIER. It is here with permission.

Dealing with uncertainty and the ‘new times’ that COVID19 has delivered has been a struggle. The New Zealand (NZ) dairy industry has been one bright spot in this crisis.

The stylised facts that support this position are:

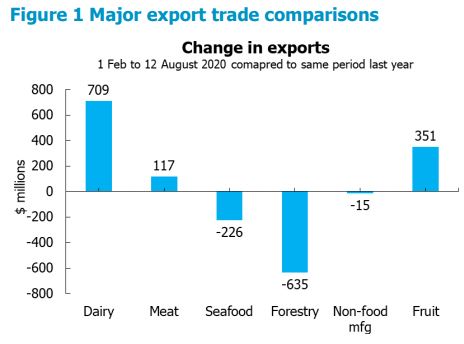

• NZ dairy exports are running $709 million above this time last year in what is a stellar performance (see Figure 1) mainly due to strong commodity prices (Rae 2020).

• The ability to trade dairy commodities has been helped because of the flexibility in product mix and country placement (NZIER 2020).

• Subsidy export trade arrangements by the US and EU have dampened down world prices1 but these subsidised exporters are leaden footed in their product mix decisions.

• Population growth and growing per capita incomes internationally are driving increased consumption of dairy products. Production of fresh milk is expected to grow by over 2 percent per annum until 2028 (Ash, 2019).

• The Chinese market – NZ’s most important customer – is still growing, i.e. consumption doubled in East Asia in the last decade (Alexandratos et al 2019).

• Industrialised nations consumption rates of dairy products are declining (Zingone 2017).

While nothing is certain, NZ’s dairy commodity trade is well positioned for the coming COVID-19 related world recession.

But what of the future in a post COVID-19 world – can the dairy industry maintain its significant contribution to the NZ economy given a mixture of demand and supply side issues? Issues include:

• The development of plant-based milk substitutes.

• Synthetic foods.

• Concerns about the dairy industry’s impact on local water quality.

• Climate change challenges – not just regulation but also the impact of droughts and the costs associated with mitigation.

• The hardy perennials: debt burdens, labour shortages (increased by COVID), and dealing with volatile milk prices.

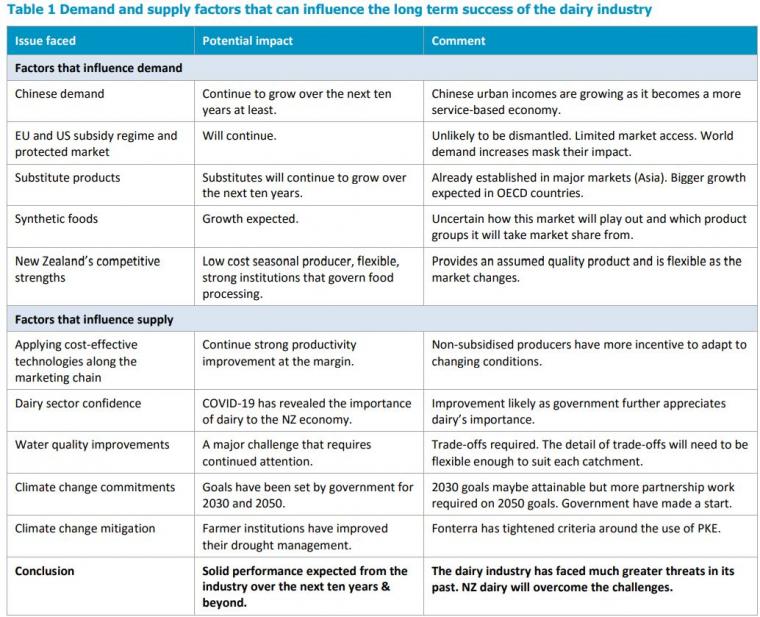

We use a demand and supply approach to classify the factors of importance that will determine the dairy industry’s future and then make a call on the long-term viability of the industry.

Do we know what side our bread is buttered on?

Who will buy is always the most critical question. The dairy industry has benefited from trade policy successes and the emergence of China as a major importer of dairy products over the past 20 years. There is a focus on milk production in China which has boosted not only domestic production but also imports. Dairy production has been supported by the 13th Five Year Plan2 intended to rationalise the Chinese supply of dairy products.

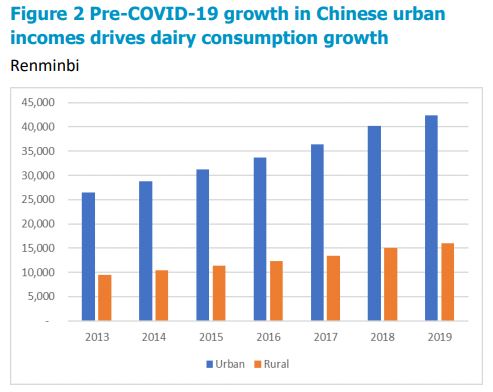

While production is growing in China, demand is outstripping supply driven by rising incomes of the urban middle class (see Figure 2).

Will this continue after the COVID crisis?

The answer is yes since China is likely to follow other countries on a path that moves from generating wealth from industrial production to a service-based economy. Not only will incomes of the urban dwellers rise but there are likely to be more of them as the economy transitions.

Milk is also perceived to be healthy (Haas et al 2019, p16). Consumption growth is driven by the awareness of milk being a source of protein, calcium, vitamins and other minerals. Further the quality means that even NZ commodity products can sell at a premium over other sources.

Lactose intolerance is becoming less of a problem in Asian consumers. Targeting of young consumers means that Asian babies are born with the ability to make lactase,3 therefore, children do not stop drinking milk as they grow up.

Chinese consumption per capita is still small relative to other parts of Asia and the world (roughly one-third of world averages). Despite this the growth has been dramatic – per capita consumption has doubled in 10 years.4

The UK exiting the EU is also likely to change dairy markets since it is the second largest dairy importer after China. While we are uncertain how NZ producers will take advantage of this market any increase in international demand will have a positive impact on world prices. How NZ might gain will become clearer as the FTA with the UK takes shape.

For these reasons – particularly growing per capita consumption and population growth – it is likely that demand will be strong for dairy products over the next ten years.

In other Asian regions, the process of industrialisation and converting to more serviced based economies is progressing. Some are further ahead (Japan, Hong Kong, and Singapore) while others are at a similar or slower pace than China. Dairy growth is expected to be more moderate in these regions.

The Indian market will be more difficult to prise open. In the world’s biggest dairy market there is a natural inclination for Indian trade policy to protect its industries, particularly agricultural industries. All countries have found it difficult to negotiate reductions in barriers (see for example the stalled EU-India FTA negotiations). 5, 6

Milk in India is mainly produced for domestic consumption. The glacially slow pace of reform is partly due to agricultural policy being dominated by the Indian states. Despite this, India will soon be the world’s third largest economy and cannot be ignored. There are likely to be opportunities for the NZ dairy industry regardless of what actions the Indian government takes.

One significant issue is the trade struggle between the US and China. How this might play out is very uncertain.

We have assumed that unlike the agricultural trade war between the US and the EU in the 1980s the impacts will not be as severe. However, NZ will be affected by the undermining of the multilateral system since US dairy products have the potential to displace NZ product in any ‘political’ deal between China and the US. In the current trade ‘tensions’ between the US and China world growth is suffering reducing prospects for further growth in dairy consumption. Under both scenarios, prospects for growth under ‘trade tensions’ and ‘political deal making’ for NZ are dimmer than what they might have been.

What are our competitors likely to do?

With moderate growth in dairy demand what are the chances that other competitors will ramp up export production and dampen down internal prices for NZ producers?

Unlikely. Why is this?

• Returns to dairy farmers are not ‘win-fall gains’ so the ability to attract new entrants is limited, i.e. those prepared to invest and bring together a club of farmers to produce milk over the long term.

• Trust from farmers is needed – a consistent repeat game is required for exports since milk needs to be picked up daily. Outside of industrialised nations the ability to replicate this certainty is limited.

• The requirement for a specialised marketing channel with significant investments in dryers and transport.

Therefore, the main competition will come from traditional European sources (the North and West in Europe)7 and the US. Unfortunately, the lack of new entrants will not make things easier. We have not seen any sign of EU and US subsidy regimes decreasing over the past five years, in fact the COVID crisis is ramping up subsidies. Whoever wins the next US election will not change this stance.8

Despite these worries the international dairy trading situation is relatively benign. In a situation of little international growth (such as in the 1970s, 1980s, and early 1990s) small changes in the subsidy regimes had major impacts on NZ – particularly from the EU. However, with the current moderate growth in demand, subsidies have had less economic impact on prices.

Further competitiveness in the EU and US is being driven by increased scale supported by technology. However, while scale is increasing it is at a much slower pace than would occur in a freer market.9 That is, subsidy regimes insulate producers and act as a drag on competitiveness, blunting the incentives to increase scale.

Despite this the growth in scale is likely to ameliorate the impact of the increasing age of the average farmer in the EU and US. Older farmers do tend to be on smaller blocks of land and are most likely to be those that exit the industry first.10

A further risk is the chance that both China and India will subsidise dairy production. Both countries place high priority on production of dairy products therefore the chances of subsidies are moderate to high over the next ten years.

One hopeful sign is the agreement by the EU and US to eliminate export subsidies (achieved in 2015 at the WTO Ministerial in Nairobi). This provides some degree of insurance cover for NZ from unfair trade, if the EU/US stick to their commitments.

As long as international demand for milk-based imports grow then the impact of subsidised competition from the EU and US will still act as a damper on prices but will be of lesser impact relative to what it was in the latter part of the twentieth century.

Substitute products for milk

Plant-based milks are growing fast in all markets around the world. Products such as soya milk have been around for some time, particularly in the Asian market – their growth continues to out-pace milk from livestock. This growth is expected to continue.11 Whether plant-based milk is taking market share from bovine milk is unclear, since in Asian markets, at least, milk consumption from livestock is still growing.12

Where plant-based milk is taking market share from livestock milk is in industrialised nations. In these markets there is a growing trend towards vegetarian, vegan, and flexitarian lifestyles (Makinen et al 2016; Derbyshire 2016).

However, even in these markets, consumers see livestock milk as a natural and healthy product (Haas et al 2019, p19): “Cow milk’s product image is … much more positive for most consumers compared with plant-based alternatives”. This is despite animal welfare and environmental impact concerns (in the EU).

Synthetic foods also need to be considered. In fibre markets, synthetics have had a major impact. The impact has been so large that the value of the bulk of strong wools in NZ does not cover the cost of shearing the sheep. Therefore, the NZ farmer is well aware of the possible impact of synthetic substitutes. Currently it is difficult to assess the claims of the media and scientists about the impacts of synthetic food. What will be most important is consumer acceptance. Given the attachment that consumers still have to milk from livestock the ability of synthetics to have a “major impact” 13 remains to be seen.

Other non-trivial issues are:

• The approach of regulators to the development of synthetic foods. Regulators are likely to take a risk adverse approach since they will be responsible for the safety of foods.

• How food is presented, i.e. will it look like the products it is intended to compete against?

• The ability to scale up production in a way that makes it profitable (efficiency).

• Environmental performance.

Where does New Zealand fit?

The COVID-19 and post COVID-19 periods look bright for the dairy industry in NZ. Demand is still growing and the ability to deliver consistently high-quality products from a trusted source (with transparent regulatory oversight) means that real prices might not increase dramatically, but they are unlikely to decline over the next ten years. This is despite the coming/current COVID-19 recession.

The challenges for NZ dairying are on the supply side. The good news is that to some extent they are controllable, although there is a huge amount of work to be done to make meaningful progress on water quality issues and meeting climate change commitments.

Flexibility is a key competitive advantage

The most important supply side issue is that NZ producers are not subsidised, therefore they can focus on maximising returns from the possible supply mix, e.g. Woodford (2018) points to the current strength NZ has in low cost whole milk powder (WMP) relative to all year-round US production which focuses on value added products.

NZIER would argue the important competitive advantage is NZ’sflexibility in seeking out areas where competitors have less of an advantage. Today it is WMP, in ten years’ time it may be another product area.

Applying technology along the value chain is natural

Having to operate without subsidies means that the dairy industry is continually pushing for innovations that a. deliver value wherever they are along the value chain and b. are cost effective.

It is often difficult to know which innovation will have the biggest impact; however, because there is pressure to innovate and deliver cost-effective solutions to issues such as traceability, capital/labour substitution (e.g. the possibility of robotic milking machines), successfully dealing with biosecurity incursions (i.e. the near wiping out of M. bovis) etc. we can be confident that incremental gains will continue.

We also expect that innovation will occur faster than in regions where milk production is subsidised. This is a distinct area of competitive advantage that will continue, e.g. possible intensification (or de-intensification) through more/less land and feed use, without detrimental impacts on the environment. All of which will have an impact on the license to farm.

Restoring confidence in the dairy sector

Industries that depend on biological processes do take time to change. It is not a matter of retooling a manufacturing plant.

In NZ, regulatory settings for decades have promoted the development of the most productive use of land.

For the land that dairy farming can be viably operated on, dairy has few real commercial competitors, i.e. no wholesale switching out of dairy is occurring since the alternative use of that land in most instances returns much less per hectare than dairy farming.

With the application of the ETS, the Zero Carbon bill, and freshwater initiatives, dairy farmers’ confidence has been knocked by the signalled change in direction. An indicator of the lack of confidence has been the low number of farm sales in the sector.

The government has made a start in improving the outlook by redirecting existing funding into Sustainable Food & Fibre Futures and improving wood processing opportunities.14

Improving rural sector confidence is a work in progress

What is required are more policies that connect a vision for agriculture (by government through its regulatory settings) and a realistic understanding of what can be achieved at the catchment level.

Improving rural sector confidence is a work in progress. What is required are more policies that connect a vision for agriculture (by government through its regulatory settings) and a realistic understanding of what can be achieved at the catchment level.

Water quality improvements must be sensible

New freshwater regulations come into force in September 2020 with the aim of preventing further: “loss and degradation of freshwater habitats and introducing controls on some high risk activities”. 15 The industry claim that this could cost NZ “$6 billion per annum in GDP losses by 2050”.16 While care is required in understanding these numbers and what they have been compared against (i.e. the assumed baseline). What we know from our own dairy modelling is that restricting milk volumes on- and off-farm can generate significant losses.

Further NZIER’s preliminary work on attitudes to freshwater suggests there is a limit to how much NZers are prepared to pay for cleaner water.17

What we are certain about is that different approaches will be required in different catchments to provide efficient and effective solutions. Therefore, we are encouraged that government is not just applying regulations and expecting farmers to comply. There is considerable engagement and evidence of learning and adaption by all parties.

In this respect, the “Our Land and Water National Science Challenge” approach that brings together adjacent farm plans and focuses on outcomes deserves more attention.18

This puts a sharp focus on the outcomes in each catchment and what trade-offs NZers are prepared to make. This is not a national discussion that has yet been had.19

It is also not clear how iwi will participate in the water quality process since they are likely to continue to have a significant regional presence and are industry participants.

Climate change needs a practical approach

NZ is committed to the Paris Agreement on Climate Change. Under this commitment, NZ has legislated a reduction in methane emission to 10 percent below 2017 levels by 2030 and between 24-47 percent below 2017 levels by 2050.

Dairy, sheep and beef may be able to reduce methane emissions by 10 percent in 2030. Both DairyNZ and Beef + Lamb NZ have raised considerable doubts that the 2050 target can be reached.20, 21

The Productivity Commission (2018) in its work on adapting to climate change does not address in any detail how this might be achieved, although it does suggest further innovation and land use change will be needed.

Targets for methane reduction in the 2nd period between 2030-2050 will need to be revisited. Importantly government have made a start on this through the “Fit for a better world” roadmap.22 What is needed is more engagement by government with the industry on how targets could be reached and the sorts of actions (and resources) that need to be put in place now to at least assist industry to move towards a durable reduction approach.

Mitigation is available and sustainable

A quiet revolution has been undertaken by livestock farmers around NZ over the past 20 years around drought management.

DairyNZ and Beef + Lamb New Zealand have put nearly 15,000 farmers through workshops on drought management. Key to success has been making good decisions early around de-stocking (either animals going to the works or moved to other regions), the need for feed budget planning, and feed management.

Dairy farmers have also been able to use palm kernel extract (PKE) more readily than other livestock farmers.23 This will continue to be a contentious issue.

Critics contend that PKE is grown in South East Asia by destroying rain forests and endangering the habitat of orangutans and Bornean gibbons. Also, there are concerns about the biosecurity risks of bringing in PKE.

Some farming leaders have also suggested that farmers should use locally sourced feed from NZ’s arable industry, although this can be limited particularly in times of drought since the crops can suffer from low yields.

Other farmers defend the use of PKE since it boosts productivity and improves animal welfare ensuring that cows do not starve: “We’re now seeing huge climate variability … No farmer wants to see their cows go hungry”.24 Fonterra, through its Farm Source stores now only buys fully certified PKE.

Fonterra also penalises farmers for overuse of PKE. Some believe that this will lead to more efficient and resilient use of feeds.25

New Zealand dairy trade has a solid future…

In the past the stiff challenges faced by the dairy industry have come from off-shore: slow growing markets and subsidised competition from the EU and US. The major change over the past 20 years has been the growth generated by the Chinese market. This growth is likely to continue for at least 10 years.

However, with success has come criticism around the socalled externalities. The preference for cleaner water and meeting climate change goals. As long as regulations:

• do not impose ‘corner solutions’, i.e. banning dairy from traditional dairying regions or assuming that business as usual continues;

• allow for trade-offs that do not heavily impinge upon dairy’s competitive advantage;

then it will continue to be a stalwart of the NZ economy that drives further growth and contributes significantly to GDP, regional employment, and tax take in the coming decades.

Notes:

1. See for example https://cor.europa.eu/en/engage/studies/Documents/CAPdeveloping-countries.pdf

2. https://en.ndrc.gov.cn/policyrelease_8233/201612/P0201911014822428503 25.pdf

3. Lactase is an enzyme essential to the complete digestion of whole milk. It breaks down lactose, the sugar that gives milk its sweetness.

4. From 18kgs in 2007 to 36kgs in 2018.

5. https://www.forbesindia.com/blog/economy-policy/recent-traits-of-indiastrade-strategy-protectionism-or-pragmatic-globalisation/

6. https://thewire.in/diplomacy/india-eu-summit-trade-talks

7. The removal of milk quotas has spurred an increase in milk-based exports.

8. The Democrats have been ambivalent towards trade in the past. It should be remembered that it took President Obama 18 months to appoint his top trade official.

9. See for example https://agrihq.co.nz/assets/DairyTrader/Rabobank-NewDawn-for-EU-Dairy-March-2015.pdf

10. https://ec.europa.eu/eurostat/documents/3217494/9455154/KS-FK-18-001- EN-N.pdf/a9ddd7db-c40c-48c9-8ed5-a8a90f4faa3f

11. Although the source might change since almonds and soya beans are water intensive crops and have a significant environmental impact.

12. https://www.bordbia.ie/industry/news/food-alerts/globaldata-on-keyinnovation-trends-in-dairy-part-1–plant-based-dairy/

13. https://www.stuff.co.nz/business/industries/97808123/synthetic-fo

14. https://www.mpi.govt.nz/about-us/our-work/fit-for-a-better-worldaccelerating-our-economic-potential/

15. https://www.mfe.govt.nz/action-for-healthy-waterways

16. https://www.dairynz.co.nz/news/proposed-freshwater-policies-could-cost-nz6-billion/

17. https://nzier.org.nz/publication/clear-as-mud-water-is-under-pressure-nzierinsight-78

18. https://www.stuff.co.nz/opinion/122399133/catchment-groups-key-tohealthy-waterways

19. The closest we have come to this was the agreement reached between stakeholders in the Land and Water Forum. http://www.landandwater.org.nz/

20. https://www.dairynz.co.nz/news/methane-target-change/

21. https://beeflambnz.com/news-views/blnz-calls-critical-changes-methaneapproach-zero-carbon-bill

22. https://www.mpi.govt.nz/about-us/our-work/fit-for-a-better-worldaccelerating-our-economic-potential/

23. Sheep and beef farmers can access palm kernel but the cost of storage, distribution equipment, and feeding regimes are a barrier to take-up rates.

24. https://www.stuff.co.nz/business/farming/106897858/dairy-industry-underfire-over-palm-kernel-imports

25. https://www.ruralnewsgroup.co.nz/dairy-news/dairy-management/time-toplan-for-pke-restrictions