There were key changes made to the DMC program relative to the first-generation Margin Protection Program for Dairy (MPP-Dairy) that have significantly improved the producer safety net.

Higher protected margin levels, lower premium costs, and additional production history coverage are all critical improvements in the safety net program. Each of these legislated changes raised the likelihood that dairy producers would use DMC as a risk mitigation tool.

Alfalfa formula revisions

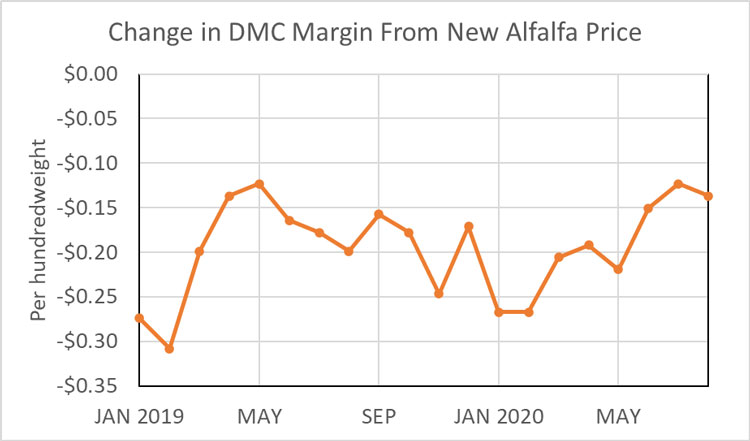

This article is focused specifically on the effect that incorporating a price for Premium and Supreme alfalfa hay that occurred in the DMC program rollout has had on the calculated DMC margin and payments. The figure below shows that using the new Supreme alfalfa price has changed the calculated DMC margin by -12 cents to -31 cents per hundredweight (cwt.) relative to the previous calculation. Although there are still a limited number of observations since the change took effect in January 2019, there appears to be some seasonality in the difference between Premium and Supreme quality alfalfa and the traditional alfalfa price with the largest premium occurring early in the calendar year.

The lower DMC margin that results from the inclusion of Premium and Supreme alfalfa hay prices has caused more DMC payments to be issued to the enrolled dairy producers. If the assumption is made that total payments to producers grew by the same proportion as the payment rate for $9.50 per cwt. coverage, then payments made by USDA to dairy producers have been more than $75 million higher since January 2019 than would have been the case using only the traditional alfalfa price.

This small change in how alfalfa prices enter the DMC margin may seem insignificant at first glance, but it has already meant millions of additional dollars paid to dairy producers. In the bigger picture, it points out one more reason that the DMC program must be considered in the risk management plans of producers.