Fundamentals are likely to steadily worsen in the coming months as milk supply expands faster year-on-year and demand slows as recession takes hold.

The YOY declines in trade are getting smaller, aided by lower prices for fats and milk powders. The coming months will likely see a continuation of major trends seen here recently – weaker cheese and butter trade due to COVID-19 exposures, alongside improved powder demand at attractive prices.

The “staggered reactivation” of food service sales is playing out. COVID-19 restrictions will continue to ease but the re-opening of foodservice outlets (seen in the US, Australia, and parts of EU) will be disrupted by “second wave” outbreaks. As was the case on the way into dealing with this pandemic, Government approaches will vary as they navigate choices between health and economic impact. This will ensure a slow and bumpy recovery in food service channels while business and tourism travel will remain limited until well into 2021.

Milk production growth in the EU and US is increasing, while domestic demand – sustained by strong grocery channel sales for cheese and butter – will be increasingly vulnerable to the effects of recession. The ongoing impacts of “trading down” by shoppers and reduced discretionary spending will weaken overall demand and increase price sensitivity.

Global protein and fat prices will generally be driven by the risk of stock-build in SMP and butter as milk supplies expand and cheese producers try to match demand. This risk is highly contingent on the sustainability of growth in cheese demand in Europe as well as prospects for increased exports, while acute tightness in the US cheese situation will gradually alleviate.

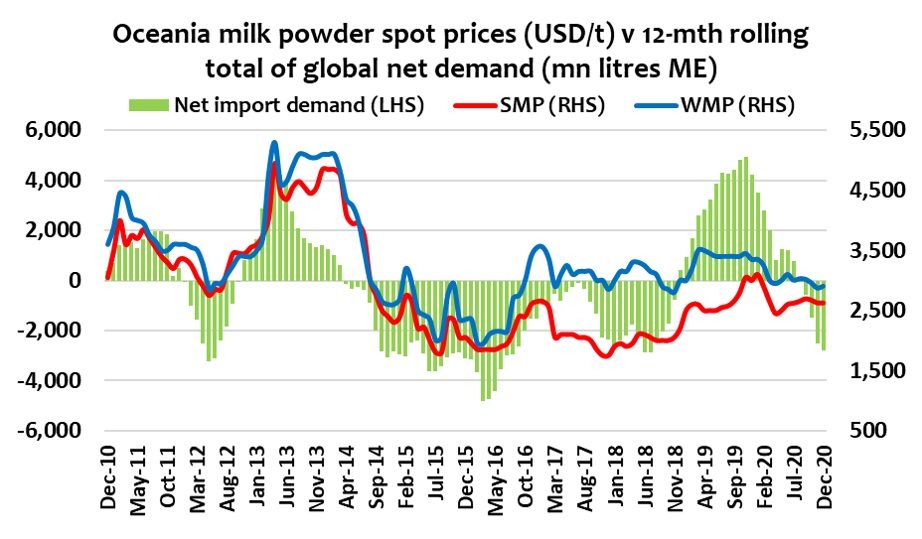

Oceania markets have been buoyed by sustained demand for WMP from China. But in this and other developing regions, butterfat and cheese demand are highly exposed to restricted food service demand, while buyers make hand-to-mouth commitments for ingredients.

Skim Milk Powder

SMP and NFDM spot values were steady through July as recovery from the COVID-19 continues.

Whole Milk Powder

Spot values have improved through July with NZ prices lifting through the month as GDT prices jumped, now selling at premium to EU product. Stronger Chinese demand at GDT events in July saw values jump significantly.

Cheese

In the US, overall cheese demand will remain under pressure. There will be a slow recovery in foodservice trade with the dire COVID-19 situation likely to extend mobility restrictions. Government purchases are likely to continue but at much smaller volumes and income subsidies are expected to taper in Q4, affecting household incomes.

Butter

Global butterfat prices continue to converge, as Oceania markets weakened due to poor demand. EU and US butter and cream prices were steady with improved retail butter demand.

Whey

Whey product prices have steadied in both the EU and US after falling in June, as COVID-19 shifted production from cheese.

The whey complex generally remains in oversupply with weak demand for higher concentrate products and expanding cheese output in the US. Dry whey prices weakened recently despite the improved trade volumes.

By Dustin Boughton, Procurement Director, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda

-Ends –

For more information or interviews contact:

Dustin Boughton | Director, Procurement – Maxum Foods

Ph: +61 409 629 866

dustin@maxumfoods.com

Maxum Foods

Maxum Foods is one of Australia and New Zealand’s principal suppliers of dairy ingredients to the Human Health and Nutrition, as well as the Animal Nutrition industries. Maxum Foods specialises in supplying medium to large-scale food manufacturers with high-quality dairy ingredients such as milk powders, cheese and butter. Backed by top-level technical support and a huge dairy ingredient range, Maxum Foods have open global supply channels to source exactly what our customers need.