This stability is expected to keep farmgate milk prices on market-based dairy contracts stable in the final months of 2020.

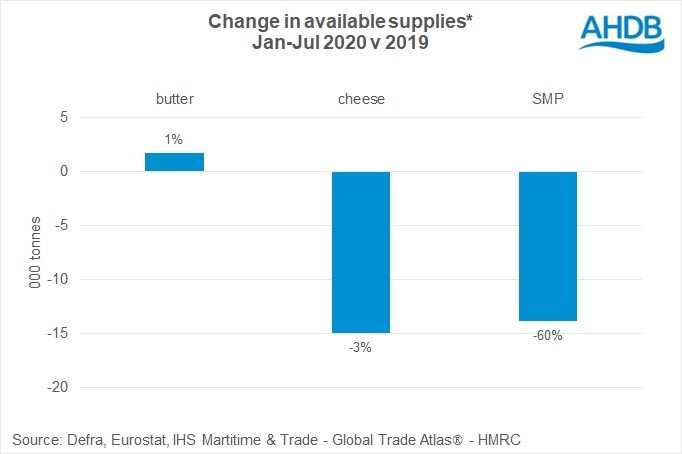

Developments in product availability relative to demand can help provide a longer term view for price trends in the markets. In the period January to July, available supplies[1] of cheese and milk powders have both tightened in comparison to their position a year ago, although for different reasons. For butter, there has been only a minor change in volumes available to the market.

The absence of any significant stock build would normally suggest upward pressure on pricing. However, the shortfall in demand as a result of reduced hospitality activity will have offset this, limiting competition for supplies and any pressure on prices.

Supplies of butter had already risen in 2019, with year on year increases in production through most of the year. In Jan-Jul 2020, production levels have been broadly similar to 2019 but imports have fallen. This was particularly the case for bulk butter, typically destined for the food manufacturing sector, with comparable volumes down by almost 30%. Conversely, imports of block butter have been higher this year, likely due to strong retail demand. Available supplies rose overall, however, as lower export demand reduced shipments.

The reduction in available cheese supplies is mostly reflective of developments in the Cheddar market. The switch in consumption from out-of-home to retail favoured domestically produced Cheddar as retailers tend to source Red Tractor certified product. The food manufacturing sector is often more price-sensitive, with imports competing with domestic product. In response to these shifts in demand, production of Cheddar has been higher, but there was an 11% drop in import volumes in the Jan-Jul period.

[1] Available supplies= production + imports – exports. The figures do not take account of stocks.